Many Runcorn people ponder the best places to invest their hard-earned savings, and the best piece of advice I can give you is to do your homework and speak to lots of people. It depends on your attitude to risk versus reward. Normally, the lower the risk, the lower the reward while a higher risk is typically associated with the possibility of higher returns, yet nothing is guaranteed. At the same time, higher risk also means higher possible losses on your investment – yet if one looks at the bigger picture, the biggest threat to investing, predominantly when the investment is made in the short term, isn’t risk but actually volatility.

So where should you invest? Building society, the stock market, gold or property are options. This article isn’t designed to give you advice – just show you how different investments have performed over the last decade.

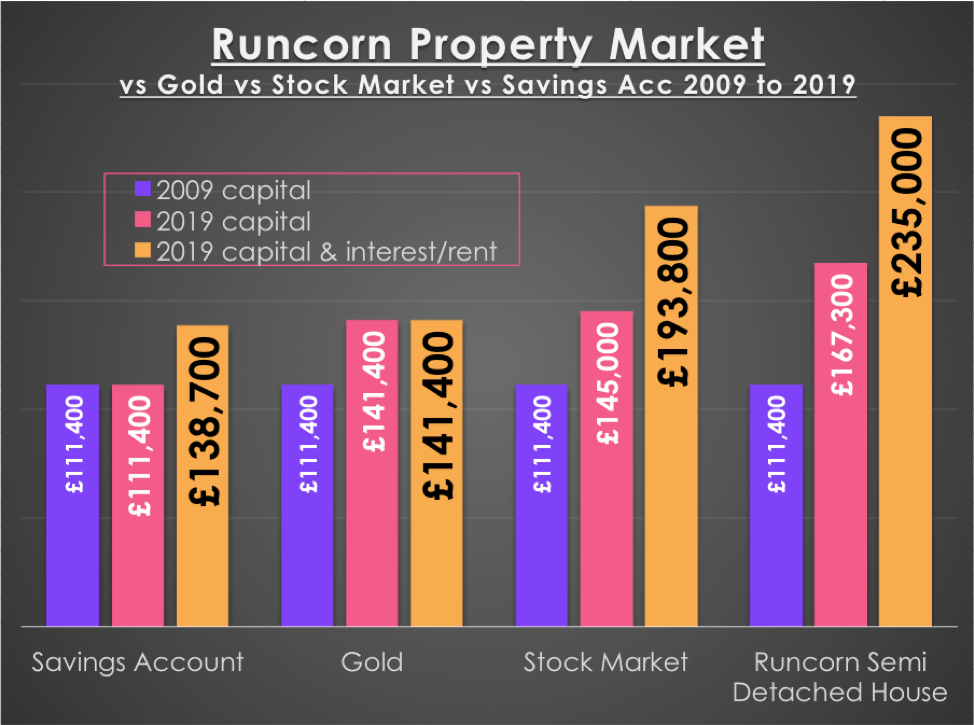

Let me start with the humble terraced house in Runcorn which in 2009 was worth £111,400. Assuming I bought that property for that figure, then I looked at what if I had invested the same amount of money in a building society, into gold and finally the stock market:

| Savings Account | Gold | Stock Market | Runcorn Semi Detached House | |

|---|---|---|---|---|

| 2009 capital | £111,400 | £111,400 | £111,400 | £111,400 |

| 2019 capital | £111,400 | £141,400 | £145,000 | £167,300 |

| 2019 capital & interest/rent | £138,700 | £141,400 | £193,800 | £235,000 |

Putting your money into the stock market (FTSE100) would have brought a return of 30.2% on your capital over those 10 years and an average of 3.79% a year in dividends (making an overall increase of 74%).

Gold doesn’t earn interest – yet it has increased in value by 26.9% over the same ten years while putting your money in the building society, the money hasn’t increased in value but would have earned you interest of 24.46% or the equivalent of 2.21% per year.

Investing in an average terraced house in Runcorn over the last ten years has seen the capital increase by 50% (an equivalent of 4.14% per annum) and the income (i.e. the rent) has provided a return, based on the original purchase price, of 110.95% or the annual equivalent of 7.75%. Therefore the overall return, based on the original purchase price of an average terraced property in Runcorn, is 11.89% per annum.

Notwithstanding No.11 Downing Street’s grab at the profits of buy to let landlords by hitting the buy to let sector with several fiscal punishments, a 3% stamp duty level, a decrease in high rate tax relief for landlords and an increase in rate of CGT on residential property profits; the facts remain that ‘bricks and mortar’ is still one of the preeminent and most constant investments available.

The bottom line is the buy to let investment remains the mainstay of the British property market, serving to support aspiring homeowners as they work to conquer the, sometimes difficult, financial obstacles of home ownership. With central government over the last 30 years only paying lip service to address the lack of new homes being built or tackling the affordability on a consequential scale, it is highly probable this will continue for the next 5/10/15 years as there will always be a call for a respectable, honest buy to let landlords delivering decent housing to those that need it.