I was recently reading a report by the Home website which suggested that hordes of landlords are selling their buy-to-let investments due to increasing burdens on them in the buy-to-let market. Their findings suggest the number of new properties that came onto the market nationally (for sale) jumped by 11% across the UK as a result.

Those increasing burdens include new tax rules coming in over the next 3 to 4 years and the announcement that all self-managing landlords (i.e. landlords that don’t use a letting agent to look after their buy-to-let property) will soon need to register with a compulsory redress scheme to resolve tenant arguments and disputes; as Westminster wants to heighten standards in the Private Rented Sector.

Interestingly I was chatting with a self-managed landlord from Preston Brook, when I was out socially over the festive period, who didn’t realise the other recent legislations that have hit the Private Rented sector, including the ‘Right to Rent’ regulations which came in to operation last year. Landlords have to certify their tenants have the legal right to live in the UK. This includes checking and taking copies of their tenant’s passport or visa before the tenancy is signed. Of course, if you use a letting agent to manage your property, they will usually sort this for you (as they will with the redress scheme when that is implemented).

If you are a self-managed landlord though, the consequences are severe because if you let a property to a tenant who is living in the UK illegally, you will be fined up to £3,000. That same Preston Brook landlord popped into my offices in the New Year, and I checked all his paperwork and ensured he was on the right side of the law going forward – and I offer the same to any landlord in the Runcorn area if you want me to cast my eye over your buy to let matters (and at no cost – ok just bring in some chocolates for the girls in the office!)

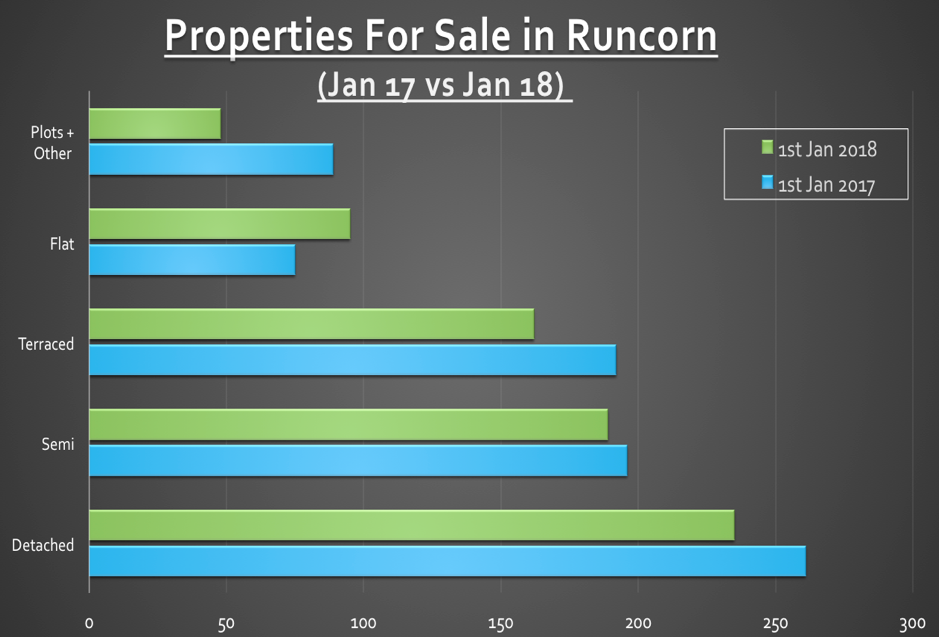

But what of all these extra properties being dumped onto the market in Runcorn? When I looked at the records the number of properties on the market in Runcorn now, as opposed to a year ago, the numbers tell an interesting story …

| 1st Jan 2017 | 1st Jan 2018 | ||

| Detached | 261 | 235 | -10% |

| Semi | 196 | 189 | -4% |

| Terraced | 192 | 162 | -16% |

| Flat | 75 | 95 | 27% |

| Plots + Other |

89 | 48 | -46% |

| Total | 813 | 729 | -10% |

Overall, Runcorn doesn’t match the national trend, with the number of properties on the market actually dropping by 10% in the last year. It was particularly interesting to see the number of flats increase by 27%, yet the number of semis on the market drop by 4%.

However, speaking with my team and other property professionals in the town, the majority of that movement in the number of properties and the types of properties on the market isn’t down to landlords dumping their properties on the market. The whole property market has changed in the last 12 months, with the majority of the change in the number and type of properties for sale due to the owner-occupier market, not landlords (a subject I will write about soon in my Runcorn Property Market blog later this Spring?). You see, for the last ten years, each month there has always been a small number of Runcorn landlords who have been releasing their monies from their Runcorn buy to let properties – as is the nature of all investments!

Nationally, the number of rental properties coming on to the market to rent fell by 16% in Q4 2017 compared to Q4 2016 .. but that isn’t because there are 16% less rental properties to rent – it’s because tenants are staying in their rental properties longer meaning less are coming on the market to be RE-LET.

Nevertheless, some Runcorn landlords will want to release the equity held in their Runcorn buy to let properties in 2018. All I suggest is that you speak with your letting agent first, as putting a rental property on the open market often spooks the tenants to hand in their notice days after you put it on the market (because they don’t like the uncertainty and also believe they will become homeless!). This means you have an empty property, costing you money with no rent coming in. However, some letting agents who specialise in portfolio management have select lists of landlords that will buy with sitting tenants in. If you have a portfolio in the Runcorn area and are considering selling some or all of them – drop me a line as I might have a portfolio landlord for you (with the peace of mind that you won’t have any rental voids).

If you’re interested in investing or have already invested in the Runcorn property market and want to discuss maximising your investments, pop in for a coffee at 60A High Street, Runcorn, WA7 1AW or visit our website www.homesmartlettings.com