My recent articles about Runcorn’s most moved street in the last three years, and the Monopoly board article (the one where I listed the most valuable streets) caused quite a lot of interest locally, so I decided to see what else I could find out about the WA7 postcode area. I have been able to find out the biggest streets in the Runcorn (WA7) postcode area.

Don’t worry. I will get back to some hard-hitting articles about the lack of new homes being built in Runcorn, the trials and tribulations of being a Runcorn buy-to-let landlord and the future of the Runcorn property market. For this article, because of the previous positive comments, I wanted to give you, the Runcorn homeowners and landlords, asked about and wanted!

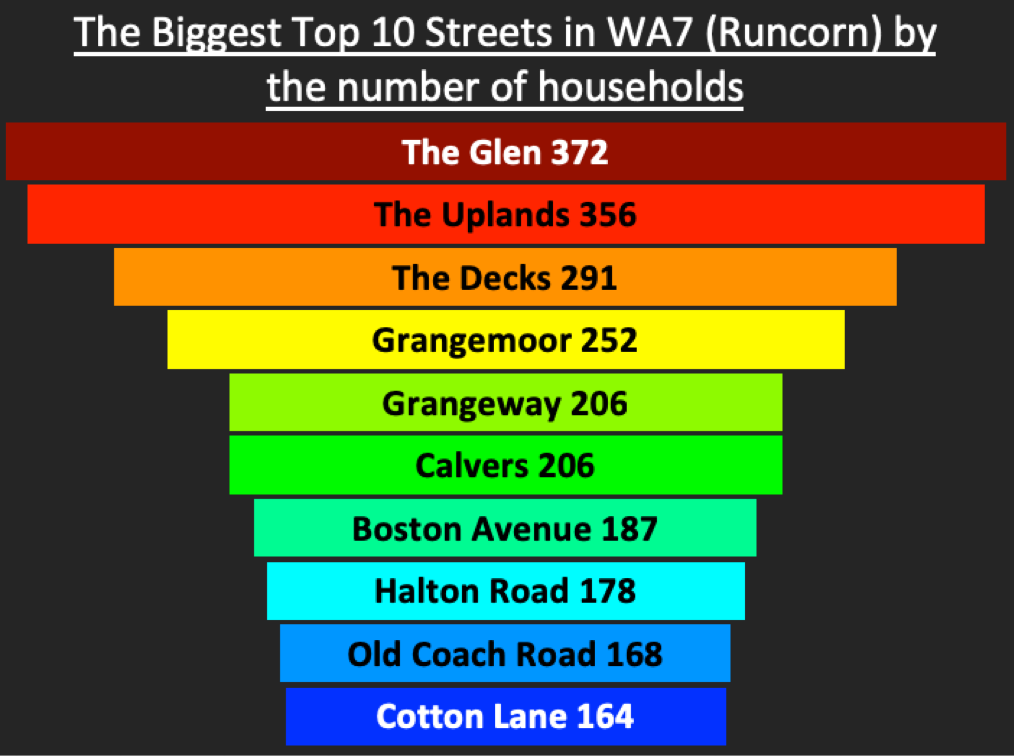

The biggest street in WA7, when it comes to the number of houses on it is The Glen, with 372 homes. In second place is The Uplands with 356 homes and in third is The Decks with 291 homes.

Not surprisingly, the most valuable street of the top 20 biggest streets is The Glen at £30.1m, with an average value of £81,000 per property.

The street with the greatest number of movers in the last three years is East Lane, with the highest saleability rate of 30.5%.

The full breakdown can be found in this chart below:

| Street/Road | Number of Properties on the Street(s) | Total Value of Properties on the Street(s) | Average Value of Properties on the Street(s) | Number of Properties Sold on that street(s) in last 36 months | Saleability/Turn-over Rate in the last 3 years (# Houses divided by sales) |

|---|---|---|---|---|---|

| The Glen | 372 | £30,133,000 | £81,000 | 19 | 5.1% |

| The Uplands | 356 | £28,077,000 | £79,000 | 15 | 4.2% |

| The Decks | 291 | £27,495,000 | £94,000 | 25 | 8.6% |

| Grangemoor | 252 | £22,811,000 | £91,000 | 19 | 7.5% |

| Grangeway | 206 | £15,778,000 | £77,000 | 10 | 4.9% |

| Calvers | 206 | £20,692,000 | £100,000 | 10 | 4.9% |

| Boston Avenue | 187 | £21,145,000 | £113,000 | 14 | 7.5% |

| Halton Road | 178 | £21,318,000 | £120,000 | 28 | 15.7% |

| Old Coach Road | 168 | £17,857,000 | £106,000 | 16 | 9.5% |

| Cotton Lane | 164 | £14,045,000 | £86,000 | 9 | 5.5% |

| Main Street | 157 | £26,567,000 | £169,000 | 15 | 9.6% |

| Sycamore Road | 156 | £13,716,000 | £88,000 | 7 | 4.5% |

| East Lane | 154 | £10,004,000 | £65,000 | 47 | 30.5% |

| Halton Brook Avenue | 149 | £13,262,000 | £89,000 | 3 | 2.0% |

| Masseyfield Road | 140 | £12,514,000 | £89,000 | 3 | 2.1% |

| Norleane Crescent | 135 | £18,340,000 | £136,000 | 14 | 10.4% |

| Charlton Close | 130 | £6,256,000 | £48,000 | 2 | 1.5% |

| Greenway Road | 124 | £17,068,000 | £138,000 | 13 | 10.5% |

| Oxford Road | 124 | £20,458,000 | £165,000 | 14 | 11.3% |

| Norton Hill | 121 | £6,758,000 | £56,000 | 1 | 0.8% |

But did you really think I wouldn’t get at all serious?

The basic rudiments of the Runcorn property market remain principally healthy in many parts of Runcorn. However, the existing political environment means that the vital element of confidence has been diminished slightly in certain parts, and that is triggering a minority of potential property purchasers and house-sellers to vacillate. With unemployment at an all-time low, a record number of people with a job, ultra-low interest rates and decent mortgage availability (with the banks and building societies tending to drop mortgage rates instead of increasing them), have adjourned their next house purchase because of perceived political uncertainty. These Runcorn first time buyers (and especially Runcorn buy-to-let landlords) should be reminded that my fellow agents have had more homes on their books than at any time over the past three or four years! There is a greater choice now of Runcorn properties to call your next home/BTL investment with a potential of securing a great property deal in the next month or so.

Irrespective of what happens with Brexit, the people of Runcorn will still need a roof over their heads, and as I have mentioned on a number of occasions, I have proved we aren’t building enough homes both locally in Runcorn and nationally. If supply is limited and demand increases (as the population grows and we get older), prices in the medium to long term can only go in one direction. Upwards!

Whatever happens with BoJo and Brexit – why wait? Because once we get over that hurdle, there will just be another hurdle and another hurdle; by which time, we will be in 2029, and you would have missed the boat. We survived the global financial crash, 3-day week in the 1970s’, hyperinflation etc. – yet the choice is yours.